I repost the commentary from Paul Krugman the 2008 Nobel Economic Winner:

Ben Bernanke ... sees “green shoots.” President Obama sees “glimmers of hope.” And the stock market has been on a tear. So is it time to sound the all clear? Here are four reasons to be cautious....

1. Things are still getting worse. Industrial production just hit a 10-year low. Housing starts remain incredibly weak. Foreclosures ... are surging again. The most you can say is that there are scattered signs that ... the economy isn’t plunging quite as fast as it was. And I do mean scattered...

2. Some of the good news isn’t convincing. The biggest positive news in recent days has come from banks, which have been announcing surprisingly good earnings. But some of those earnings reports look a little ... funny.

Wells Fargo, for example, announced its best quarterly earnings ever. But ... reported earnings ... depend a lot on the amount the bank sets aside to cover expected future losses on its loans. And some analysts expressed considerable doubt about Wells Fargo’s assumptions...

Meanwhile, Goldman Sachs announced a huge jump in profits... But as analysts quickly noticed, Goldman changed its definition of “quarter” ... so that — I kid you not — the month of December,... a bad one..., disappeared from this comparison.

I don’t want to go overboard... Maybe the banks really have swung from deep losses to hefty profits in record time. But skepticism comes naturally in this age of Madoff.

Oh, and for those expecting the Treasury Department’s “stress tests” to make everything clear: the White House spokesman, Robert Gibbs, says that “you will see in a systematic and coordinated way the transparency of determining and showing to all involved some of the results of these stress tests.” No, I don’t know what that means, either.

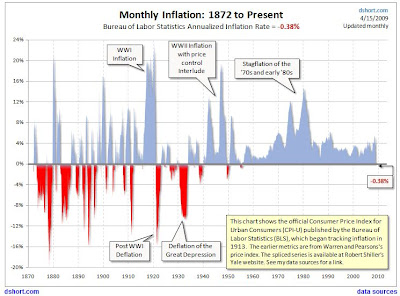

3. There may be other shoes yet to drop. Even in the Great Depression, things didn’t head straight down. There was, in particular, a pause in the plunge about a year and a half in — roughly where we are now. But then came a series of bank failures on both sides of the Atlantic, combined with some disastrous policy moves...

Can this happen again? Well, commercial real estate is coming apart at the seams, credit card losses are surging and nobody knows yet just how bad things will get in Japan or Eastern Europe. We probably won’t repeat the disaster of 1931, but it’s far from certain that the worst is over.

4. Even when it’s over, it won’t be over. The 2001 recession officially lasted only eight months... But unemployment kept rising for another year and a half. The same thing happened after the 1990-91 recession. And there’s every reason to believe that it will happen this time too. Don’t be surprised if unemployment keeps rising right through 2010. ... Employment will eventually recover... But it probably won’t happen fast.

So now that I’ve got everyone depressed, what’s the answer? Persistence.

History shows that one of the great policy dangers, in the face of a severe economic slump, is premature optimism. F.D.R. responded to signs of recovery by cutting the Works Progress Administration in half and raising taxes; the Great Depression promptly returned in full force. Japan slackened its efforts halfway through its lost decade, ensuring another five years of stagnation.

The Obama administration’s economists understand this. They say all the right things about staying the course. But there’s a real risk that all the talk of green shoots and glimmers will breed a dangerous complacency.

So here’s my advice, to the public and policy makers alike: Don’t count your recoveries before they’re hatched.