Thursday, April 23, 2009

Who's the lier?!

Bank of America Chief Executive Kenneth Lewis told the New York attorney general he believed former Treasury Secretary Henry Paulson and Fed Chairman Ben Bernanke wanted him to keep quiet about the worsening terms of the bank's acquisition of Merrill Lynch, according to testimony reviewed by The Wall Street Journal.......

Now, folks you know why I kept angry about former Treasury Sec. Henry Paulson and Fed Chairman Bernanke. They are all liers and not to sever us as taxpayer to any agree of benefit. They only care about their own $$$. Always waiting when is best time and how to get more $$$ out of our hard earn tax $$$. The Bush Administartion and so is current one both are playing huge ponzi scheme to us. America is totally fcuk up. I am very very very very very very very very sad about our future with these kind of people running our government.

Wednesday, April 22, 2009

Cycles of Psychology!!

Tuesday, April 21, 2009

Uptrend is weakening!!

4/21/09

Banking stocks do get their rebound today. However, it is little bit short term overbought, I expect there will be pullback at early morning hours. In fact, I am bearish. I guess market will going down more from here. Despite any good or bad earnings from companies, volatility is arrived again.

Monday, April 20, 2009

Intermediate Term High may be reached!!!

Which bank is not lending??!

4/20/09

4/20/09A new analysis form Wall Street Journal Newspaper seems to confirm the worst nightmares that the government's financial rescue programs would turn out to do nothing more than pour taxpayer money into zombie banks who would hoarde capital rather than lend it into the economy. According to The Journal, Journal, the biggest recipients of taxpayer aid made or refinanced 23% less in new loans in February than they did in October.

Recall that October was the month after the collapse of Lehman supposedly froze the credit markets and it was the month when the government launched Troubled Asset Relief Program.

Some quick data points from the Journal's analysis:

- The total dollar amount of new loans declined in three of the four months the government has reported this data.

- All but three of the 19 largest TARP recipients originated fewer loans in February than in October.

Why isn't this drop in lending more widely known? Mostly because the way the Treasury calculates the pace of lending understates the problem. The Treasury measures the median performance of the banks. This way of measuring lending from banks winds up missing the zombifying effects of bailouts, where banks are encouraged to hoarde capital in order to bolster their financial health rather than lend out money injected by the government.

Here's how the Journal breaks down the lending from each bank. Notice who is on top with the biggest decline in lending? That's right, Goldman Sachs, the Wall Street firm that suddenly declared it had enough to pay back the TARP.

My comment: Now, you all know what I am so angry about current Washington Administration. They cannot make commercial banks lend out any more $$ to avert forzen credit market or our economy up to date. Fcuk them all.

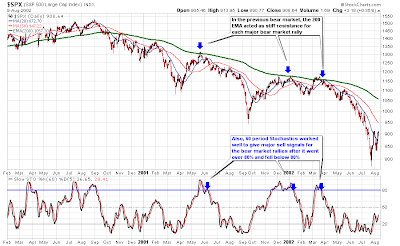

Review 2000 Bear Market in Chart

Sunday, April 19, 2009

Resistance is reached!!

4/19/09

Finally, the thrilling bear market rally has finally reached Feb High around 875-880. Expect larger pullback will be occurred very soon. Moreover, volaility is getting high. Not too much to say. BAC and AXP earning report will be announced tomorrow. Will financial sector help the Bulls one more day??!