7/30/09

From Bloomberg today:

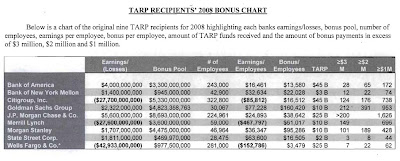

Citigroup Inc. and Merrill Lynch & Co., recipients of taxpayer bailout funds under the Troubled Asset Relief Program, paid out a combined $9 billion in bonuses last year after suffering total losses of $54 billion, according to a report by New York Attorney General Andrew Cuomo.

In the report on “bank bonus culture” published today, the state analyzed 2008 bonuses at nine banks that received TARP financing from the U.S. government. New York-based Citigroup and Merrill, since taken over by Bank of America Corp., received TARP funding totaling $55 billion, Cuomo said in his report.

“When the banks did well, their employees were paid well. When the banks did poorly, their employees were paid well,” Cuomo’s office said in the 22-page report. “When the banks did very poorly, they were bailed out by taxpayers and their employees were still paid well. Bonuses and overall compensation did not vary significantly as profits diminished.”

The report also said that Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co. paid out a total of $18 billion in bonuses in 2008 while having received a combined total of $45 billion in taxpayer dollars through TARP. Together, the three firms earned only $9.6 billion last year, Cuomo said.

My comments:Who want to be millionaire? Go work in big banks. Oh, I have question about how come some banks they did not even have profit, and they are still getting more money out for bonus??? Are they getting our money to pay those folks bonus?? http://www.youtube.com/watch?v=HQ79Pt2GNJo

http://www.youtube.com/watch?v=HQ79Pt2GNJo