Thursday, December 24, 2009

Definitely good article to enjoy for Xmas 2009!!!

Yes,even stock market recover lots this year since March. I am still very bearish for 2010 and later for our economy as well as US stock market. Here is a very good article saying the fact that we are facing(somehow cannot reprint here, please click the link and check it out)

http://www.scribd.com/doc/24470953/Sprott-December

Saturday, December 19, 2009

Citibank outstanding Shares

12/18/09

Folks! Do you wanna own piece of Citicorp or Citibank shares? I know I do not. Simply, go to yahoo finance check out their market cap is about $77 B. Then, check out JPM market cap is about $160 B. So, if Citibank is going to be like JPM. The most reasonable stock price for Citi probably would be around $7. Let's say $7-$10. So, I do not think Citi is good for long term. It is good to treat as trading stock. Good luck if you own this piece of crap.

Tuesday, November 24, 2009

FDIC broke !!!

It has been long time since I sign back in and write something. In fact, I rather re-post someone comments on FDIC issue. Yes, it is scary to know FDIC is broke.

Off the wire this morning:

FDIC Deposit fund had negative $8.2B balance in Q3

That's broke. Bankrupt. Kaput. Gone. Poof. Dead. Rotting. A corpse.

Yes, yes, I know, Treasury has their back. But let's not forget - The FDIC does not have a legal "full faith and credit" guarantee from the US Federal Government and Treasury.

It has a "sense of Congress" resolution, but not a formal, legally-binding guarantee.

I am not, by the way, predicting an actual FDIC failure to pay. Should such an event happen it would be tantamount to a declaration of revolutionary war (by the government about to be deposed!) as if there is one thing that would cause Granny to reach for her shotgun, it would be getting screwed out of her life savings after Sheila Bair and everyone else in our government has trotted out how their money is "fully safe" and that "nobody has ever lost a penny of insured deposits and never will" for more than 20 years, including lots of pronouncements of exactly that mantra over the last year.

Nonetheless this outlines the underlying problem the FDIC has - it has willfully and intentionally ignored the fact that banks have mismarked their "assets" to overstate their values, it has refused to demand that accounting be done on a strict "mark to market" basis by bank examiners, and indeed, it has backed the "extend and pretend" commercial real estate "rollover" provisions of recent months, all of which is manifestly unsound and intentionally misleading.

The result?

THE FDIC IS BROKE.

Tuesday, September 15, 2009

We Americans are Hostage ?!!!

It has been awhile I write something in my blog. The following is written by a guest blogger and it is very make sense to read.

The American people have been taken hostage to a broken system.

It is a system that remains in place to this day.

A system where bank lobbyists have been spending in record numbers to make sure it stays that way.

A system that corrupts the most basic principles of competition and fair play, principles upon which this country was built.

It is a system that so far has forced the taxpayer to provide the banks with the use of $14 trillion from the Federal Reserve, much of the $7 trillion outstanding at the US Treasury and $2.3 trillion at the FDIC.

A system partially built by the very people who currently advise our President, run our Treasury Department and are charged with its reform.

And most stunningly — it is a system that no one in our government has yet made any effort to fundamentally change.

Like health care, this is a referendum on our government’s ability to function on behalf of the American people. Ask yourself how long you are willing to be held hostage? How long will you let our elected officials be the agents of those whose business it is to exploit our government and the American people at any cost?

As hostages — was there any sum of money we wouldn’t have given AIG?

Why did we pay Goldman Sachs and all the other banks 100 cents on the dollar for their contracts with AIG, using taxpayer money, while we forced GM and others to take massive payment cuts?

Why hasn’t any of the bonus money paid to the CEOs that built this financial nuclear bomb been clawed back?

And more than anything else — why does the US Congress refuse to outlaw the most anti-competitive structure known to our economy, one summed up as TOO BIG TOO FAIL?

It has become startlingly clear that we as a country, and I as a journalist, had made a grave error in affording those who built and ran those banks and insurance companies the honorable treatment of being called capitalists. When in fact the exact opposite was true, these people were more like vampires using the threat of Too Big Too Fail to hold us hostage and collect ongoing ransom from the US Government and the American taxpayer.

This was no unlucky accident. The massive spike in unemployment, the utter destruction of retirement wealth, the collapse in the value of our homes, the worst recession since the Great Depression all resulted directly from these actions.

Even with all that — the only changes that have been made, have been made to prop up and hide the massive flaws on behalf of those who perpetuated them. Still utterly nothing has been done to disclose the flaws in this system, improve it or rebuild it.

Last fall was an awakening for me, as it was for many in our country.

And yet, our Congress has yet to open its eyes, much less do anything about it. In fact conditions have never been better for the banks or worse for the rest of us.

Why is this? Who does our Government work for? How much longer will we as Americans tolerate it? And what, if anything, can we do about it?

As we approach the anniversary of the bailouts for our banks and insurers — and watch the multi-trillion taxpayer-funded programs at the Federal Reserve continue to support banks and subsidize their multibillion bonus pools, we must ask if our politicians represent the interests of America? Or those who would rob America of its money and its future?

As a country, we must demand that our politicians stop serving those whose business models are based on systemic theft and start serving those who seek to create value for others — the workers, innovators and investors who have made this country great.

My comments: I have very strong feeling attach to it. How about you?

Thursday, August 27, 2009

Someone has called "Top" !!!

Here are Doug’s 10 reasons why the rally has run out of steam and has “likely topped:”

1. Cost cuts are a corporate lifeline and so is fiscal stimulus, but both have a defined and limited life.

2. Cost cuts (exacerbated by wage deflation) pose an enduring threat to the consumer, which is still the most significant contributor to domestic growth.

3. The consumer entered the current downcycle exposed and levered to the hilt, and net worths have been damaged and will need to be repaired through higher savings and lower consumption.

4. The credit aftershock will continue to haunt the economy.

5. The effect of the Fed’s monetarist experiment and its impact on investing and spending still remain uncertain.

6. While the housing market has stabilized, its recovery will be muted, and there are few growth drivers to replace the important role taken by the real estate markets in the prior upturn.

7. Commercial real estate has only begun to enter a cyclical downturn.

8. While the public works component of public policy is a stimulant, the impact might be more muted than is generally recognized. There may be less than meets the eye as most of the current fiscal policy initiatives represent transfer payments that have a negative multiplier and create work disincentives.

9. Municipalities have historically provided economic stability — no more.

10. Federal, state and local taxes will be rising as the deficit must eventually be funded, and high-tax health and energy bills also loom.

My comments: It is very make sense!! Good luck if you still think we are in recovery!!

Monday, August 24, 2009

Scared number showing Commerical Loan!!!

Do not be fooled by this "recovery"!!!

I find out very great article to read:

Andy Xie is a former Morgan Stanley economist now living in China; The following is from the South China Morning Post:

>

The A-share market is collapsing again, like many times before. It takes numerous government policies and “expert” opinions to entice ignorant retail investors into the market but just a few days to send them packing. As greed has the upper hand in Chinese society, the same story repeats itself time and again.

A stock market bubble is a negative-sum game. It leads to distortion in resource allocation and, hence, net losses. The redistribution of the remainder, moreover, isn’t entirely random. The government, of course, always wins. It pockets stamp duty revenue and the proceeds of initial public offerings of state-owned enterprises in cash. And, the listed companies seldom pay dividends.

The truly random part for the redistribution among speculators is probably 50 cents on the dollar. The odds are quite similar to that from playing the lottery. Every stock market cycle makes Chinese people poorer. The system takes advantage of their opportunism and credulity to collect money for the government and to enrich the few.

I am not sure this bubble that began six months ago is truly over. The trigger for the current selling was the tightening of lending policy. Bank lending grew marginally in July. On the ground, loan sharks are again thriving, indicating that the banks are indeed tightening. Like before, government officials will speak to boost market sentiment. They might influence government-related funds to buy. “Experts” will offer opinions to fool the people again. Their actions might revive the market temporarily next month, but the rebound won’t reclaim the high of August 4.

This bubble will truly burst in the fourth quarter when the economy shows signs of slowing again. Land prices will start to decline, which is of more concern than the collapse of the stock market, as local governments depend on land sales for revenue. The present economic “recovery” began in February as inventories were restocked and was pushed up by the spillover from the asset market revival. These two factors cannot be sustained beyond the third quarter. When the market sees the second dip looming, panic will be more intense and thorough.

The US will enter this second dip in the first quarter of next year. Its economic recovery in the second half of this year is being driven by inventory restocking and fiscal stimulus.

However, US households have lost their love for borrow-and-spend for good. American household demand won’t pick up when the temporary growth factors run out of steam. By the middle of the second quarter next year, most of the world will have entered the second dip. But, by then, financial markets will have collapsed.

China’s A-share market leads all the other markets in this cycle. Even though central banks around the world have kept interest rates low, the financial crisis has kept most banks from lending. Only Chinese banks have lent massively. That liquidity inflated the mainland stock market first, then commodity markets and property market last. Stock markets around the world are now following the A-share market down.

By next spring, another stimulus story, involving even bigger sums, will surface. “Experts” will offer opinions again on its potency. After a month or two, people will be at it again. Such market movements are bear-market bounces. Every bounce will peak lower than the previous one. The reason that such bear-market bounces repeat is the US Federal Reserve’s low interest rate.

The final crash will come when the Fed raises the interest rate to 5 per cent or more. Most think that when the Fed does this, the global economy will be strong and, hence, exports would do well and bring in money to keep up asset markets. Unfortunately, this is not how our story will end this time. The growth model of the past two decades - Americans borrow and spend; Chinese lend and export - is broken for good. Policymakers have been busy stimulating, rather than reforming, in desperate attempts to bring growth back. The massive increase in money supplies around the world will spur inflation through commodity-market speculation and inflation expectations in wage setting. We are not in the midst of a new boom. We are at the last stage of the Greenspan bubble. It ends with stagflation.

Hong Kong’s asset markets are most sensitive to the Fed’s policy due to the currency peg to the US dollar. But, in every cycle, stories abound about mysterious mainlanders arriving with bags of cash. Today, Hong Kong’s property agents are known to spirit mainland-looking men, with small leather bags tucked under their arms, to West Kowloon to view flats. Such stories in the past of mainlanders paying ridiculous prices for Hong Kong flats usually involved buyers from the northeast. In this round, Hunan people have surfaced as the highest bidders. The reason is, I think, that Hunan people sound even more mysterious. But, despite all this talk, the driving force for Hong Kong’s property market is the Fed’s interest rate policy.

Punters in Hong Kong view the short-term interest rate as the cost of capital. It is currently close to zero. When the cost of capital is zero, asset prices are infinite in theory. At least in this environment, asset prices are about story-telling. This is why, even though Hong Kong’s economy has contracted substantially, its property prices have surged. Of course, the short-term interest rate isn’t the cost of capital; the long-term interest rate is. Its absence turns Hong Kong into a futile ground for speculation, where asset prices increase more on the way up and decrease more on the way down.

When the Fed raises the interest rate, probably next year, Hong Kong’s property market will collapse. When the Fed’s policy rate reaches 5 per cent, probably in 2011, Hong Kong’s property prices will be 50 per cent lower.

Andy Xie is an independent economist

My comments:It is much better to hear opinion from Independent economist rather bias hired one from others.

Friday, August 21, 2009

Deficit to the moon again!!

It is no surprise to see this as news today:

WASHINGTON (Reuters) - The Obama administration will increase its 10-year budget deficit projection to roughly $9 trillion from $7.108 trillion in a report next week, a senior administration official told Reuters on Friday.

The 2010-2019 cumulative deficit projection replaces the administration's previous estimate of $7.108 trillion, said the official, who is familiar with the plans.

"The new forecasts are based on new data that reflect how severe the economic downturn was in the late fall of last year and the winter of this year," the official said.

"Our budget projections are now in line with the spring and summer projections that the Congressional Budget Office put out."

I have no comment. All I know we are going to be so so so broke very soon.

Some figure for Existing Home Sale today!!

Housing and foreclosure analyst Mark Hanson sends along some more reasons to be a bit skeptical when looking at today's big existing home sales leap.

Here's a few of the internals he cites:

- Existing Home Sales would have been negative over June if not for the increase in Northeast Condo sales

- Single Family Detached sales were DOWN 5k units m-o-m

- In the all-important Western region, existing sales were DOWN 10%.

- Last summer selling season, existing sales were up 5 months in a row going into July

- Foreclosure activity in July increase by 24k m-o-m - more than existing home sales

Wednesday, August 12, 2009

Recession is OVER ????

8/12/09

Apparently, it's over. Out of 27 economists, not a single one sees GDP falling in 2010. Not sure if that is comforting.

WSJ: After months of uncertainty, economists are finally seeing a break in the clouds. Forecasts were revised upward for every period, with 27 economists saying the recession had ended and 11 seeing a trough this month or next. Gross domestic product in the third quarter is now expected to show 2.4% growth at a seasonally adjusted annual rate amid signs of life in the manufacturing sector, partly spurred by inventory adjustments and strong demand for the "cash for clunkers" car-rebate program.

A better-than-expected employment report for July, where employers cut 247,000 jobs and the jobless rate fell for the first time in 15 months, suggests the worst is over. The unemployment rate is still expected to rise to 9.9% by December, but economists forecast that the economy will shed far fewer jobs over the next 12 months than they had forecast last month.

Warning: Past performance may be an indication of economists' future results.

My comments: I am sure year later, the all 27 economists are going to resign from their post. Yes, we will see!!

Tuesday, August 11, 2009

Next Wave Down will be bigger !!!

Bob Prechter "Quite Sure" Next Wave Down Will Be Bigger and March Lows Will Break

In late February, Robert Prechter of Elliott Wave International said "cover your shorts," and predicted a sharp rally that would take the S&P into the 1000 to 1100 range.

With that prediction having come to pass, Prechter is now saying investors should "step aside" from long positions, and speculators should "start looking at the short side."

"The big question is whether the rally is over," Prechter says, suggesting "countertrend moves can be tricky" to predict. But the veteran market watcher is "quite sure the next wave down is going to be larger than what we've already experienced," and take major averages well below their March 2009 lows.

Yes, the late 2007-early 2009 market debacle was just a warm-up to what Prechter believes will be the bear market's main attraction. In this regard, he says the current cycle will echo past post-bubble periods such as America in the 1930s and England in the 1720s, after the bursting of the South Sea bubble.

The 2000 market peak market a "major trend change" for the market from a very long-term cycle perspective, and the downside is going to continue to be painful well into the next decade, Prechter says. "The extreme overvaluation, the manic buying and bubbles in the late 1990s [and] mid-2000s are for the history books - they're very large," he says. "The bear market is going to have balance that out with some sort of significant retrenchment."

My comments: Who is Bob Prechter?! Check out yourself. Hmm, I am well-prepared. How about you?!

Stock markets are technically very overbought !!!

Please, Please, and please read the following carefully, it is written by one of my favorite technical analysts(not hired by any financial firms)......

And by overbought, I mean WAY overbought.

The relative strength index (RSI) is a metric used to measure the velocity and momentum of a given investment by comparing its upward and downward moves from close-to-close. If an investment is moving up strongly, its RSI is higher. Similarly, if an RSI is low, it means the investment is performing weakly.

Historically, RSI’s of 70 or higher mean an investment is overbought while an RSI of 30 means an investment is oversold. In these situations the market is primed for a “revert to the mean” trade, meaning you could see a quick correction or turnaround rally as the market snaps back to a more reasonably RSI.

Well, have a look at Friday's NASDAQ.

As you can see, the NASDAQ recently hit an RSI of 75. This is the highest reading we’ve seen in nearly two years. In fact, the last time the NASDAQ had an RSI of 75 was October 10, 2007, right before stocks entered their first major leg down in the Financial Crisis, losing 55% in six months.

As soon as I noticed this, I called up Ron Coby, a brilliant portfolio manager based in Medford, Oregon. Ron’s one of the smartest guys I know and when it comes to trading short-term moves, he’s one of the best in the business. What he had to say completely blew me away.

Ron said,“Graham, you won’t believe this, but I went back on the NASDAQ and made a note of every time it hit an RSI of 75. EVERY TIME, the market collapsed soon after. And I don’t mean a “plain vanilla” correction, I mean a full blown CRASH.”

Ron then forwarded me the following chart. Suffice to say, I was floored:

As you can see, the NASDAQ has hit an RSI of 75 or higher five times in the last 12 years. Every time, the market collapsed soon after with an average drop of -22%. In several cases, stocks suffered a full-blown CRASH.

This is a very serious warning for the Bulls. A high RSI doesn’t mean that stocks have to CRASH immediately. But it does indicate that the NASDAQ is more than ready for a serious correction. Again, an RSI of 75 or higher has only been hit FIVE times in the last 12 years. Two of those times were at massive historic bubble peaks. The others were all periods in which stocks were simply far too overbought. And ALL FIVE OF THEM PRECEDED SERIOUS CORRECTIONS.

Be forewarned, if stocks are this overbought, we’re in dangerous territory. If smart money like Ron Coby is worried and shifting to a defensive stance, I’m paying attention.

I suggest you do the same.

My comments:At two weeks before, I have already noticed this overbought condition. Watch out ahead!! Yeah...it is coming!!!Monday, August 10, 2009

New Toxic Products from our old Banks !!!

In case everyone miss this frisky news from Business week. I repost it here:

Lenders haven't sworn off risky financial products. They've come up with a slew of new ones

That didn't take long. The economy hasn't yet recovered from the implosion of risky investments that led to the worst recession in decades -- and already some of the world's biggest banks are peddling a new generation of dicey products to corporations, consumers, and investors.

| More from BusinessWeek.com: • The Big Banks Enabled Subprime Lenders • The Top 25 Subprime Lenders • Banks: Good News -- and Bad Assets |

In recent months such big banks as Bank of America (BAC), Citigroup (C), and JPMorgan Chase (JPM) have rolled out newfangled corporate credit lines tied to complicated and volatile derivatives. Others, including Wells Fargo (WFC) and Fifth Third (FITB), are offering payday-loan programs aimed at cash-strapped consumers. Still others are marketing new, potentially risky "structured notes" to small investors.

There's no indication that the loans and instruments are doomed to fail. If the economy keeps moving toward recovery, as many measures suggest, then the new products might well work out for buyers and sellers alike.

But it's another scenario that worries regulators, lawmakers, and consumer advocates: that banks once again are making dangerous loans to borrowers who can't repay them and selling toxic investments to investors who don't understand the risks -- all of which could cause blowups in the banking sector and weigh on the economy.

| More from Yahoo! Finance: • Lucrative Fees May Deter Efforts to Alter Troubled Loans • Subprime Brokers Resurface as Dubious Loan Fixers • Big Car Bargains: Deal or No Deal Visit the Loans Center |

CDS-Linked Corporate Credit Lines

Some of Wall Street's latest innovations give reason for pause. Consider a trend in business loans. Lenders typically tie corporate credit lines to short-term interest rates. But now Citi, JPMorgan Chase, and BofA, among others, are linking credit lines both to short-term rates and credit default swaps (CDSs), the volatile and complicated derivatives that are supposed to act as "insurance" by paying off the owners if a company defaults on its debt. JPMorgan, BofA, and Citi declined to comment.

In these new arrangements, when the price of the CDS rises -- generally a sign the market thinks the company's health is deteriorating -- the cost of the loan increases, too. The result: The weaker the company, the higher the interest rates it must pay, which hurts the company further.

The lenders stress that the new products give them extra protection against default. But for companies, the opposite may be true. Managers now must deal with two layers of volatility -- both short-term interest rates and credit default swaps, whose prices can spike for reasons outside their control.

Making matters more difficult for corporate borrowers: high fees. Banks are raising their rates for credit lines across the board -- but the new CDS-based credit lines cost far more than the old lines. FedEx (FDX) could end up paying $1.9 million to $3.6 million a month if it decides to tap a new line from JPMorgan and Bank of America. On its previous line with JPMorgan, FedEx would have paid about $540,000.

Yet many companies have little alternative. With corporate credit remaining tight, banks increasingly are steering borrowers to the CDS-linked loans. All told, lenders have handed out nearly $40 billion worth this year -- roughly 70% of the total in credit lines extended to borrowers in fairly good standing. That's up from around 14% in 2008. FedEx, United Parcel Service (UPS), Hewlett-Packard (HPQ), and Toyota Motor Credit have all taken the plunge. "It wasn't our idea," says a UPS spokesman. "The banks pulled back from offering set rates."

Big Banks Offering Payday Loans

At the other end of the borrower spectrum, big banks are entering another controversial arena: payday loans, whose interest rates can run as high as 400%. Historically the market has been dominated by small nonbank lenders, which mainly operate in poor urban centers and offer customers an advance on their paychecks. But big lenders Fifth Third and U.S. Bancorp (USB) started offering the loans, while Wells Fargo continues to boost its payday-loan program, which it began in 1994.

More big banks are getting into the market just as a recent flurry of usury laws has crippled smaller players. In the past two years lawmakers in 15 states have capped interest rates on short-term loans or kicked out payday lenders altogether. The state of Ohio, for example, has imposed a 28% interest rate limit. But thanks to interstate commerce rules, nationally chartered banks don't have to follow local rules. After Ohio limited rates, Cincinnati-based Fifth Third, which has 400 branches in the state but also operates in 11 others, introduced its Early Access Loan, with an annual interest rate of 120%. "These banks are skirting state laws," says Kathleen Day of advocacy group Center for Responsible Lending. Says a spokeswoman for Fifth Third: "Our Early Access product fully complies with federal regulations and applicable state regulations."

Lenders argue they offer a valuable service for those who need emergency cash. Wells Fargo says it warns customers using its Direct Deposit Advance that the loan is expensive and tries to offer alternatives. "We have policies in place to prevent long-term usage of the services," says a spokeswoman. U.S. Bancorp didn't return calls.

National regulators are taking notice, however. The Office of Thrift Supervision says it is "looking into" two institutions that are offering the high-interest loans. "We need to make sure there's no predatory lending and also ensure that there are no risks to the institutions," says an OTS spokesman.

Derivatives for Small Investors

On the investing front, too, Wall Street firms are embracing more risk. Big brokerage houses, including Morgan Stanley Smith Barney (MS) and UBS (UBS), are selling new forms of "structured notes," a type of debt instrument. Wall Street sold $15 billion of the products in the second quarter, up from $13 billion in the first, according to StructuredRetailProducts.com. Some of the new notes have a minimum investment of only $1,000.

Structured notes are essentially derivatives for small investors -- and they make sense for some. Basic structured notes let buyers benefit from the growth in stock, bond, or currency prices while offering some degree of loss protection. But many of the latest iterations are highly complex and may not compensate for all the risk. Buyers "have to have the [financial] experience to be able to evaluate the risk," says Gary L. Goldsholle, general counsel at the Financial Industry Regulatory Authority, the securities industry's self-governing organization.

The new debt investments offer attractive rates, sometimes guaranteeing double-digit returns for the first couple of years. But when those teaser rates disappear, investors face huge potential losses over the life of the instrument, up to 15 years. A Morgan Stanley spokeswoman says the firm "services a broad range of products for retail and ultrahigh-net-worth clients," including structured products, and "offers training to financial advisers to assist them in making suitability determinations." UBS declined to comment.

The risks to investors can be tough to tease out of the prospectus. A July offering from Morgan Stanley promises 10% interest for the first two years. After that, it pays 10% when short-term interest rates and the Standard & Poor's 500-stock index both stay within certain ranges. If they don't, the investment pays nothing.

The prospectus says the latter scenario would have been a rare event over the past 15 years. But as the recent market turmoil has shown, historical patterns aren't always reliable. Investors in similar notes got burned last year when Lehman Brothers failed. Says Bob Williams, a broker at Delta Trust Investments in Little Rock who's often pitched on such investments: "I'm not convinced half the brokers in this country, much less their clients, understand these products."

My comments:WTF!! How come our bank regulator let them sell these frisky products to us ??? Are they keep saying need to tighten the standard??? Damn!! You all know why I am still very bearish. Good luck to America. I am totally 100% sure we are going into doom world.Saturday, August 8, 2009

Should you believe what expert analysts predict ??!

8/8/09

I find out very reliable data about how our so proud Wall Street Analysts have done for their job:

The incomparable James Montier--once of SocGen, soon of GMO--blasts the Efficient Market Hypothesis (EMH) in a recent speech (via John Mauldin). Let's leave the EMH aside for a moment and just focus on one simple point.

Most investment economic analysis is devoted to forecasting the future. Unfortunately, the evidence is in...and it's clear that people can't forecast the future.

In my opinion [trying to forecast the future] is one of the biggest wastes of time, yet one that is nearly universal in our industry. Pretty much 80-90% of the investment processes that I come across revolve around forecasting. Yet there isn't a scrap of evidence to suggest that we can actually see the future at all.

For example, the last chart shows how good economists are at forecasting GDP.

Note that, year in, year out, the forecasts stay very close to the average GDP growth rate. Of course, everyone knows that the economy is cyclical, so forecasting this way is absurd. But economists simply have no ability to forecast the turns:

And how about stock analysts? How are analysts at predicting how stocks will do over the next year?

Terrible. See the middle chart above!!

Analysts just pick targets that are close to the average annual return for the average stock in recent years--then cross their fingers and pray. Of course, stocks are cyclical, too. And once again, analysts have no ability to call the turns.

My comments: Now, you see those called analysts are working for their own company best interest. They are not doing the prudent job to advise or give good idea to us. Period. Also, look at the very first chart I post above. Now, we are at reflective wave. What do you think?

Thursday, August 6, 2009

No recovery for consumer spending !!!

One of every 10 American workers will be without a job by early 2010, economists project, shaking the confidence of those still on payrolls and discouraging spending. It may take as long as 15 years for consumers to fully repair finances battered by the decline in home values, stocks and employment, said Edmund Phelps, winner of the Nobel prize in economics in 2006.

Decreasing pay is not the only hurdle for consumers. Plunging home prices and stocks reduced household net worth by a record $13.9 trillion from the third quarter of 2007 through this year’s first quarter, according to figures from the Fed.

“Households are going to have to do an awful lot of rebuilding of their wealth,” Phelps, a professor at Columbia University in New York, said this week in an interview on Bloomberg Television. “Even if that rebuilding goes on at a pretty good clip, it will take 12 or 15 years for households to get to the wealth level that they had several years ago. Consumer demand is going to take a long time to rebuild to normal levels.”

My comments: It is just opinion by Nobel Prize economist. However, it does make very sense. Just ask yourself, do you spend less compare the time you were one or two years ago?! And, are you going to increase your spending on coming months?! I guess you all know the answer.

Surprise move by Bank of England !!!

Recent polls by Bloomberg and a Shadow MPC report calling for an end to QE from the Bank of England are way off the mark with the Bank of England announcing this morning that not only will they extend the QE programme, but also double the expected GBP25B addition to GBP50B. This takes the total programme to GBP175B. The MPC has said that the world economy remains in recession, despite increasing signs that the output in the UK’s export market is stabilizing, and that financial markets are still fragile even with noticeable improvements. This has weighed tremendously on Sterling across the board, and could very well set the tone for the day. Rates were left unchanged at 0.50% as expected.

My comments: Wow. Bank of England is increasing the failed move again to put addition money into qualitative easing. That act is telling everyone that they are still in very very bad shape. Also, their view of the world economy is still remains in recession. Will next week our US Fed would catch on the same conclusion? Should we reduce the QE or follow England?? I would say Fed has to keep what they are doing(Even though I think it is not working well), there no interest rate adjust until next year(Actually, I would say they never have a chance to consider to raise interest rate again). They will keep purchase government bonds period!!

Chinese Bubble 2.0 !!

Recently, I have been putting lots of effort into creating video chinese blog site. Therefore, I wrote less technical stuffs here. The following is catching my attention: ..

Putting aside price charts of the Chinese equity market for now and turning to monetary measures, we can see something rather alarming happening. China’s M2 has enjoyed a constant rate of acceleration as shown in the chart below (in semi log scale). But in late 2008 the rate of acceleration suddenly increased dramatically:

This was a consequence of the massive stimulus plan put into motion by the Chinese government. They pumped unprecedented amounts of liquidity into their economy to offset the world-wide economic slowdown. There would be nothing singularly alarming about that since all central banks around the world, as well as governments in charge of fiscal policy, have orchestrated a collective burst of activity.

What is alarming is that the Chinese economy, stock market and especially real estate market are just now displaying bubble-like characteristics. The government controlled banking sector is a mystery wrapped in an enigma. No one can begin to fathom the amount of non-performing loans on the books. Unlike the US which went through a gut wrenching cleansing - thanks to the largess of the lobby-less taxpayer, the financial sector is once again back in fighting shape (privatized profits, public losses). China has yet to address their toxic assets

As we briefly touched on before, since last year’s low the Shanghai market has now appreciated more than 100%. Once again the stock market has enthralled the average person in China with thoughts of wealth and the possibility of making more in a month than what they earn in a year at their regular job. Speculation in the market is seen as not only a legitimate way to make money but a very lucrative one with low barriers to entry.

A sure sign of a bubble is extreme turnover. Recently, the total Chinese stock market turnover (in one day) reached $63 billion. That’s more than the combined total turnover of $58 billion in London, New York and Tokyo for the same day!

I know we’ve been having an especially humdrum summer (in volume) but also consider that within the $58 billion turnover are billions of dollars worth of Chinese shares and ETFs (traded on North American exchanges).

Morgan Stanley Asian economist, Andy Xie says in a recent research report: “The stock market is in a final frenzy again. The most ignorant retail investors are being sucked in by the rising momentum.”

Turning to the real estate market, there is more bad news. The two rock solid methods of real estate valuation: personal income to price ratio and rental yield to price ratios are beyond extreme.

Although the US per capita income is approximately seven times that of China’s urban per capita income, the price per square feet is almost equal. Rental yields on properties is negligible with most below inflation levels - meaning that the primary rationale for buyers is continued future price appreciation not future rents earned.

Like other bubbles, this will end very badly. That is for certain. What isn’t certain is when exactly the music will stop.

One clue may be the date that many in China are eyeing as the expiration date of a Chinese government underwritten put option: October 1st, 2009 - the 60th anniversary of the National Day of the People’s Republic of China. The general belief is that the government will do everything in its power to not ‘lose face’ before that date so as to not mar the celebration. Of course, whether this is true or not is irrelevant. All that matters is that enough believe it to be so.

The reason I spend so much time thinking and writing about the Chinese economy and financial markets is that they are now a significant part of the global landscape. The precarious nature of this fragile recovery is even more clear when we realize just how pivotal a role China plays. Unless the rest of the world can recover fast enough to back on its feet before China’s bubble bursts, this could get ugly.

You can play this with obvious Chinese ADR shares like Baidu (BIDU) which does a very good job of tracking the Shanghai Stock Exchange composite with an added beta boost. And you can also use Chinese ETFs and closed end funds like the iShares FTSE/Xinhua China 25 (FXI).

You can read more of Andy Xie’s analysis here.

My comments: Oooopps!! It is warning sign now. Yes, if you see something rate of speed going up like crazy..like chinese stock market. You know there is something burning. Let's watch out, folks!!Wednesday, August 5, 2009

Who bail out our postman ??!

The following news is no surprise to everyone in America:

(AP) The post office says it lost $2.4 billion from April to June.

That brings the year's losses so far to $4.7 billion. And the Postal Service expects to be $7 billion in the red when the fiscal year ends on Sept. 30. The stark figures come from a decline in mail volume as people rely more on e-mail, plus a dip in advertising mail because of the recession.

In an effort to reduce costs, the agency has proposed closing several hundred local post offices, has asked Congress for permission to reduce mail delivery to five days a week, and has reduced hours at many offices.

My comments: Well, I guess we will expect huge layoffs from Postal Office. Anyone like to guess how many postman will be out of job before 2010? 10,000, 20,000 or even 30,000 ? I do not see any recovery at my sight for our economy. Even no job growth in Federal government and they are coming about to layoff big time. Mr President: Where can we find the jobs you keep saying or stop eliminating?? Where,...I still do not see it. Do you see any, folks?!

Warren Buffet "Bailout" ?!!

8/5/09

This chart, which Winkler produced, shows the extent to which Buffett portfolio companies ahve relied on government handouts

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

He even traded the bailout, seeking morally hazardous profits in preferred stock and warrants of Goldman and GE because he had “confidence in Congress to do the right thing” — to rescue shareholders in too-big-to-fail financials from the losses that were rightfully theirs to absorb.

All of what Winkler says is undoubtedly true, though we think Winkler is probably overstating the case a bit. At some point, we'll have to get over the idea that anyone who was rescued during a bank run is stained for the rest of their existence. If these banks all repay the TARP and roll over their government-backed debt into non-government backed debt, does it make sense to keep complaining that during a crisis they had to be rescued.

What's more, Buffett himself did not need a rescue. Sure, he benefitted from the government's intervention, and it's also true that Berkshire Hathaway (BRK) by being too big to fail had implicit backing from the government, if it ever came to that, but it didn't, and we still maintain that the fact that since nobody's found a timebomb lurking in side Berkshire somewhere -- when nearly every other financial company had one -- is a testament to the fact that he's practiced, more or less, what he's preached.

My comment: Hey, no wonder he does asking people buying stocks when Dow is trading at 9,000. When would be my turn to get bail out by goverment?!Thursday, July 30, 2009

No wonder everyone want to be banker ?!!

7/30/09

From Bloomberg today:

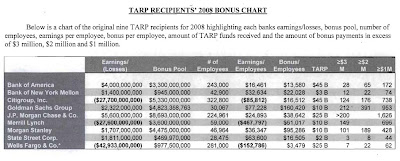

Citigroup Inc. and Merrill Lynch & Co., recipients of taxpayer bailout funds under the Troubled Asset Relief Program, paid out a combined $9 billion in bonuses last year after suffering total losses of $54 billion, according to a report by New York Attorney General Andrew Cuomo.

In the report on “bank bonus culture” published today, the state analyzed 2008 bonuses at nine banks that received TARP financing from the U.S. government. New York-based Citigroup and Merrill, since taken over by Bank of America Corp., received TARP funding totaling $55 billion, Cuomo said in his report.

“When the banks did well, their employees were paid well. When the banks did poorly, their employees were paid well,” Cuomo’s office said in the 22-page report. “When the banks did very poorly, they were bailed out by taxpayers and their employees were still paid well. Bonuses and overall compensation did not vary significantly as profits diminished.”

The report also said that Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co. paid out a total of $18 billion in bonuses in 2008 while having received a combined total of $45 billion in taxpayer dollars through TARP. Together, the three firms earned only $9.6 billion last year, Cuomo said.

My comments:Who want to be millionaire? Go work in big banks. Oh, I have question about how come some banks they did not even have profit, and they are still getting more money out for bonus??? Are they getting our money to pay those folks bonus??Insiders are selling like crazy !!!

Despite more and more people calling this is brand new bulls market and economy is running V-shape turn around. Let's read the following:

""Executives in charge of the largest US companies sent a signal of their concerns by selling far more shares than they bought this month, according to data based on Securities and Exchange Commission filings.

Share sales by so-called company insiders are outstripping purchases so far this month by more than 22 times. TrimTabs, the investment research company, said insiders of S&P 500 listed companies have unloaded $2.6bn in shares in June, compared with $120m in purchases.

“The smartest players in the US stock market – the top insiders who run public companies – are not betting their own money on an economic recovery,” said Charles Biderman, chief executive of TrimTabs.""

Tuesday, July 28, 2009

Ooops, what was ben bernanke thinking back then???

http://www.youtube.com/watch?v=HQ79Pt2GNJo

http://www.youtube.com/watch?v=HQ79Pt2GNJoCopy that link and see!! Ben was so damn wrong!!! and now he said...

http://www.marketwatch.com/story/bernanke-explains-crisis-to-average-americans-2009-07-26?siteid=rss&rss=1

Why he still be first chair person to control our nation economy??!! Damn it!! However, majority of economists are also missed judge this mess. Well, what can we say??!

Still consolidate with bullish bias !!!

Monday, July 27, 2009

Record Treasury Yeild !!!

Let's look at why people over the world keep buying US Government Bonds!!! Or kinda bail us out of this big mess!!

Bloomberg is reporting Real Yields Highest Since 1994 Aid Record Debt Sales.

The highest inflation-adjusted yields in 15 years are helping provide the Treasury with record demand at auctions as the U.S. prepares to sell $115 billion of notes this week.My comment: Wow!! 5.10% for 10 year government bonds. What a very damn attractive interest rate. I would love to park my saving in that, wouldn't anyone??! Are US is going to issue more damn bonds with higher interest rate on the road??! I bet they have no choice. I expect to see more government bonds with much much higher interest rate months later. We will see!!

Treasuries are the cheapest relative to inflation since 1994 after consumer prices fell 1.4 percent in June from a year earlier. The real yield, or the difference between rates on government securities and inflation, for 10-year notes was 5.10 percent today, compared with an average of 2.74 percent over the past 20 years.

The gap helps explain why investors are buying bonds after losing 4.8 percent this year, the steepest decline on record, according to Merrill Lynch & Co. indexes that date back to 1978.

Gann Analysis Long Term Predict !!

7/27/09

I expect market will test the primary down trend line, same as 1:2 Gann's time line. The time would be approximate first quarter of 2010. This is my studies by using Gann's theory and E-wave. Believe it or not, it is up to you. I here to declare it probably will happen and market will make new lows. Yes, I still believe we will see DOW 4,000-4,500 next year !!!

Real Estate Quote of the Day and more !!!

Please check my other blog link:cigstockchart.blogspot.com for technical market analysis.

Folks, check this out, despite we have better New Home Sales number today,...

"National New Home Sales, on a monthly basis, don’t even add up to half of the total foreclosure activity in California alone in a single month.”

Now, is that called "Green Shoot"??! You can choose to believe it or not!

Friday, July 24, 2009

Wednesday, July 22, 2009

Tick..Tick...Ticking Boom is coming !!!

It has been awhile I write anything here. However, I find no good news since last time I update my blog. The only good news is stock market running like super bulls market. Let's read the following:

Federal Reserve Chairman Ben S. Bernanke said a potential wave of defaults in commercial real estate may present a “difficult” challenge for the economy, without committing to additional steps to aid the market.

Bernanke, testifying before the Senate Banking Committee today, urged lenders to modify “problem” mortgages to avert defaults. Christopher Dodd, the Connecticut Democrat who chairs the panel, told Bernanke that “some have suggested” the commercial market “may even dwarf the residential mortgage problems” in the U.S.

It “may be appropriate” for the government and Congress to consider “fiscal” steps to support the industry, Bernanke said today. Ideas for fresh support for the market could include government guarantees for commercial mortgages, Bernanke also said today, while noting no proposal on the subject has emerged.

U.S. commercial property prices fell 7.6 percent in May from a month earlier, bringing the total decline to 35 percent since the market’s peak, Moody’s Investors Service said in a report this week. Commercial properties in the U.S. valued at more than $108 billion are now in default, foreclosure or bankruptcy, almost double than at the start of the year, Real Capital Analytics Inc. said earlier this month.

“As the recession’s gotten worse in the last six months or so, we’re seeing increased vacancy, declining rents, falling prices -- and so, more pressure on commercial real estate,” Bernanke said yesterday. “We are somewhat concerned about that sector and are paying very close attention to it. We’re taking the steps that we can through the banking system and through the securitization markets to try to address it.”

One of the main issues for the industry is that the market for debt backed by commercial mortgages “has completely shut down,” the Fed chief said yesterday.

Folks, remember what our Fed Chairman has said since 2005...

- In 2005 Bernanke said there was no housing bubble to bust. "[Housing] increases, he said, "largely reflect strong economic fundamentals," such as strong growth in jobs, incomes and the number of new households.

- Less than two years ago he said things were contained.

- In January 2008, he said housing would improve by the end of the year.

Wednesday, July 8, 2009

Market support still held !!

Interesting comments from former assitant Treasury Secretary !!!

The following is an interesting comments from a very outspoken Former Assistant Treasury Secretary(Craig Roberts) on the bailouts, the dollar, and Goldman Sachs.

Craig Roberts: Bank bailout was a fraud and it won't succeed. Don't not know what sort of stupidity the Treasury Secretary and the Federal Reserve will resort to next.

Max Keiser: Quick question. What should the Treasury Secretary be doing?

Craig Roberts: He should be trying to save the dollar as the world's reserve currency which means stopping the wars, reducing the bailout money, and trying to reduce the trade and budget deficits in order to save the dollar. That's what he should be doing.

Max Kesier: Does the treasury secretary work for the people or does he work for the banking system on Wall Street?

Craig Roberts: He works for Goldman Sachs.

My comment: Even the government former co-worker think our Treasury Secretary is a dump fool!! What a shame for America and us!!

Tuesday, July 7, 2009

What ??! Pradon Me !! 2nd Stimulus ....

As I always thought, our government are only keep printing money without solving any issue or helping our economy at all. None!! Period!! As every major news source....

"I think we need to be open to whether we need additional action," said by House of Representatives Majority Leader Steny Hoyer.

And

Laura D'Andrea Tyson, an economic adviser Obama, said on Tuesday in Singapore that the United States should be planning for a possible second round of fiscal stimulus and focused on infrastructure investment.

What?! then consider sunday our vice president admitted:

"we misread how bad the economy was....."

Everybody, let see where they so called experts economists and white house bought us into? They are liable for what their economic policy. Correct!! You cannot just admit "I was damn wrong back then underestimate how bad our economy will go...." those all f*&^ BS stuffs. We are not children, white house, we now all are feeling, seeing, frustrating about our future, fake hope of 2nd half year recovery. I swear to you white house folks:"Recovery your ass" Now, to make us fool again to introduce 2nd stimulus wasting money scheme. Damn. Good luck to us all !!!

Monday, July 6, 2009

Market still hold above key support !!!

7/6/09

Market is still able holding on above key support 8200 for Dow!! Expect more rebound for tomorrow morning.

Economic reports are rather light this week. Only items worth paying attention to are ISM index and Initial jobless claims for May.

Alcoa will kick off 2nd quarter earnings. Right now, expectations for these earnings is not very high.

Geither (Treasury) and Elizabeth Duke (Federal Reserve) will speak this week.

Group of Eight Summit in Italy is an important event. China has once again proposed a new world currency. This will affect the market mood. However, it is unlikely that such proposal will have any long lasting consequences.

Thursday, July 2, 2009

MJ Thriller to Californians !!!

Let's read the following, do not take it too serious if you are Californian. Actually, our Illinoisian are going to be next.

Dear Californians,

It sucks to be you today, though our weather here in NYC is awful so you might have it better on that front. Nevertheless, a lot of you who in some way are connected to the state are getting paid in IOUs. Some banks will accept them on a case-by-case basis, but good luck buying groceries with them, or paying your auto loan or even your rent.

The good news is that one (1) of you will get some cash today, courtesy of Clusterstock! We're offering to pay one (1) of you $500 (can be via PayPal) for $1,000 worth of bona fide, California state-issue IOUs, provided we can work out the transaction.*

We think $.50 on the dollar is a fair price, and we've love to buy more, but we don't want to be overwhelmed by you desperate Californians looking to unload your worthless paper for our valuable paper (you know, the kind we use in New York, the money capital of the world. It's green, in case you've forgotten. It doesn't tear easily and it's hard to counterfeit. In short, real money is pretty awesome, and if we were you, we'd be happy to get our hands on some)

So send us an email and we'll see what we can work out.

Take it as a joke to laugh for your holiday.

Besure read NY times, they have graphical form to tell you about 30 states are having their budget problem for next fiscal year.

Know more of Non Farm Payroll

Its tine for everyone’s favorite monthly data point, Non-Farm Payrolls.

For those of you who are relatively new to the site, here is a brief description of how our analysis has evolved over time.

My comment: Let's focus on last paragraph, the leading indicator analysis. "Hours Worked". Today it released average work hours are 33 weekly, the lowest record for the series since 1964. It tells me no recovery is in process. Also, how come today figure are way far off economist estimate, actual is lost 467,000 the estimate is 365,000. Damn, what a projection miss !!! Also, open your eye wide to see one of the sector is keep losing jobs which is government sector, it still lose 62,000 jobs for month of June. Come on, are we already passing the stimulus package 4 months ago and Mr. President said it will create 3 to 4 millions job for this and next years ??? Where is the money gone and where is the job being created from? Why our government still laying off 62,000 jobs for month of June. Why?? Why??? Why?? Do you know the answer?? It is so obviously that someone has eaten the money and not doing the job. Now, some folks start talking about the 2nd stimulus package. F*** them !!! I aint see any recovery. How about you?? It is a very good logical question you can enjoy for the Happy national long weekend to all.• Weak Jobs Recovery: Following the 2001 Recession, the economic recovery, from a jobs perspective, was rather weak. Indeed, from 2002-07, we had the weakest employment recovery of any post-recession period since World War 2. This data point — widely ignored on Wall Street and MSM — was a warning sign that the recovery was abnormal. It is what sent us looking for what was driving the economy — and the answer was borrowed money.

• Survey Data: There are two employment surveys — Establishment and Household. Establishment works of employment tax data; Household is literally a Q&A survey. They sometimes vary dramatically, but when you control so they measure the same thing, they come pretty close to each other (most of the time).

• Birth Death Adjustment: A major modification to the NFP measure is the Birth Death adjustment. Changes to the BD were proposed in 2001, and implemented a few years later. This attempts to capture early improvements in employment at the start of a recovery was the goal. The trade off is it wildly overstates strength at the end of a cycle. For example, in 2007, approximately 75% of reported new jobs were due to this adjusatment. In 2008, the BD adjustment inexplicably showed lots of job creation in construction and finance.

• Measuring Unemployment: The main measure of Unemployment is the widely reported U3 Unemployment Rate — but my analysis of U3 has been that it significantly understates unemployment. Fortunately, a more complete measure of labor under-utilization is available – the U6 measure. They seem to run parallel, but U6 captures a lot more of the unemployed and under-employed workers than U3 does.

• Leading vs Lagging Indicators: Lastly, economists will tell you that Employment is a lagging indicator, meaning that it lags the economic cycle, getting worse even after the economy begins to improve. And that is mostly true. However, since we are investors by trade, we want o identifty aspects of Employment data that have the qualities of a leading indicator — i.e., they improve before the economy does. There are at least 2 worth paying attention to: Temporary Help, and Hours Worked. Both aspects improve or worsen prior to the a recovery or recession occurring.

Happy July 4th to all!!

Wednesday, July 1, 2009

Dumb White house economist prediction

Let's see what NY Times said:

In the weeks just before President Obama took office, his economic advisers made a mistake. They got a little carried away with hope.

To make the case for a big stimulus package, they released their economic forecast for the next few years. Without the stimulus, they saw the unemployment rate — then 7.2 percent — rising above 8 percent in 2009 and peaking at 9 percent next year. With the stimulus, the advisers said, unemployment would probably peak at 8 percent late this year.

We now know that this forecast was terribly optimistic. The jobless rate has already reached 9.4 percent. On Thursday, the Labor Department will announce the latest number, for June, and forecasters are expecting it to rise further. In concrete terms, the difference between the situation that the Obama advisers predicted and the one that has come to pass is about 2.5 million jobs. It’s as if every worker in the city of Los Angeles received an unexpected layoff notice.

There are two possible explanations that the administration was so wrong. And sorting through them matters a great deal, because they point in opposite policy directions.

The first explanation is that the economy has deteriorated because the stimulus package failed. Some critics say that stimulus just doesn’t work, while others argue that this particular package was too small or too badly constructed to make a difference.

The second answer is that the economy has deteriorated in spite of the stimulus. In other words, the patient is not as sick as he would have been without the medicine he received. But he is a lot sicker than doctors realized when they prescribed it.

To me, the evidence is fairly compelling that the second answer is the right one. The stimulus package does seem to have helped. But its impact has been minor — so far — compared with the harshness of the Great Recession.

Unfortunately, the administration’s rose-colored forecast has muddied this picture. So if at some point this year or next the White House decides that the economy needs more stimulus, skeptics will surely brandish that old forecast.

Worst of all, the economy really may need more help.Now, look at my prediction at 1/1/09 for 2009 outlook:

The S&P 500 will re-test the 750 lows in the first half of 2009, and we will close below 700 by the end of 2009. This bear market will not end in 2009.

Crude oil will stay below $80/barrel for all of 2009.

Gold will break out above $1000/oz.

The VIX will hit over 80 or make new high to 100 for the first time ever.

Unemployment rate will hit over 10.0%. Total Unemployment (U-6) will hit 20%.

Housing prices will keep dropping without finding any bottom.

Commercial real estate values will drop 30-40%. Land development, office space, warehouses, shopping malls, hotels, and resorts will do the worst. Large multi-family properties will do the “best” because they will house all the folks who will lose their homes.

20% of retailers will file for Chapter 11 bankruptcy.

The bailout money will run out in first half of 2009 and the Fed/Treasury will request an additional package…and be denied. This debate will drag on for months and months.

Numerous local municipalities and/or states will go bankrupt. Many states will be unable to pay out full unemployment benefits.

Yes,I am still very bearish. I do not see how our Bear Market(the worst since great depression as I pointed out in early 2008) can last for only 2 years. The last tech bear market lasted for about 2 1/2 years. In addition, the last 9 bear markets after world war II that all did not involve a global credit crisis! So, there are sure more disappointments ahead the hollow secular bear market ever.

My comment: Some of my observation/predictions are correct. Some are still wait to see. For example, even I am not economist, I am still able seeing unemployment rate will higher than 10% 6 months ago. What are those white house economists thinking about??? What do you think? Folks. Are those economists make a good call?? I am laughing loud to them. For such very easy economic data(Unemployment) that they cannot even predict close in range, what do think they are all able to rescue our nation economy? We will hear new unemployment rate tomorrow for month of June. Now, we are sitting 9.4% already, that very far off from those experts prediction. I guess my 10% guess is still too optimisic. Now, I guess we can see 11% at the end of 2009 so easy. Good luck to all!!

Tuesday, June 30, 2009

AIG ok reverse spilt and say will repay all $$ !!!

“We believe there is an excellent chance that we can repay the government.”

-AIG Chief Executive Officer Edward Liddy

Why is that doubtful? Well, in 2006, they had revenues of $113 billion and profits of $14 billion — about 25% of her profits were due to AIG FP.

Now, with their reputation in tatters and their revenues cut in half, their “Enterprise Value” at a mere $91 billion, and a market cap at just over $3 billion, they are going to pay back $182.5 billion?

My comment: What do you think? Anyone with common sense know that it is impossible!!

Tuesday, June 23, 2009

Insiders are selling their ass off this fake rally !!!

Bloomberg is reporting Insiders Exit Shares at the Fastest Pace in Two Years

Executives at U.S. companies are taking advantage of the biggest stock-market rally in 71 years to sell their shares at the fastest pace since credit markets started to seize up two years ago.

Insiders of Standard & Poor’s 500 Index companies were net sellers for 14 straight weeks as the gauge rose 36 percent, data compiled by InsiderScore.com show. Amgen Inc. Chairman and Chief Executive Officer Kevin Sharer and five other officials sold $8.2 million of stock. Christopher Donahue, the CEO of Federated Investors Inc., and his brother, Chief Financial Officer Thomas Donahue, offered the most in three years.

Sales by CEOs, directors and senior officers have accelerated to the highest level since June 2007, two months before credit markets froze, as the S&P 500 rebounded from its 12-year low in March. The increase is making investors more skittish because executives presumably have the best information about their companies’ prospects.

“If insiders are selling into the rally, that shows they don’t expect their business to be able to support current stock- price levels,” said Joseph Keating, the chief investment officer of Raleigh, North Carolina-based RBC Bank, the unit of Royal Bank of Canada that oversees $33 billion in client assets. “They’re taking advantage of this bounce and selling into it.”

My comment and so is the other blogger: If insiders don't believe this rally, why should you?

Another hard evidence to show why this is another giant sucker rally as I said few months ago. Period. People, I am much much better than almost anyone you hear, listen and watch. Do not believe those "BS" this is new bull market!!

Green Shoot on housing??! What green shoot??

The NAR just report:

Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 2.4 percent to a seasonally adjusted annual rate of 4.77 million units in May from a downwardly revised level of 4.66 million units in April, but remained 3.6 percent below the 4.95 million-unit pace in May 2008.

...

Total housing inventory at the end of May fell 3.5 percent to 3.80 million existing homes available for sale, which represents a 9.6-month supply at the current sales pace, down from a 10.1-month supply in April.

...

Distressed properties, which declined to 33 percent of all sales in May from 45 percent in April ...

Yun said the appraisal problem is serious. “Lenders are using appraisers who may not be familiar with a neighborhood, or who compare traditional homes with distressed and discounted sales,” he said. “In the past month, stories of appraisal problems have been snowballing from across the country with many contracts falling through at the last moment. There is danger of a delayed housing market recovery and a further rise in foreclosures if the appraisal problems are not quickly corrected.”

My comment:On Yun's word, Professional appraisaer is doing their honest job nowadays. There is no problem from appraisal. It just means the damn house is still pricing too high compare to reality. So, housing price is still too high compare to current situation, bleak employment, too many distressed house around, many default is coming, lack of demand of new home building around,..... Folks, what do you think? I am laughing the expert Lawrence Yun at what he said.

Monday, June 22, 2009

Bloody Sellf off start !!!

2009 Nation's Housing Report from Harvard University

The U.S. housing market will rebound eventually, according to a Harvard University report. Demographics and underbuilding are conspiring to up demand and revive home prices.

But that day still is a long way off, perhaps not until sometime after 2010, the university’s Joint Center for Housing Studies said in its 2009 State of the Nation’s Housing report

...

•Read the press release: HERE!

•Read the fact sheet: HERE!

•Read the report: HERE!

My comment:It is very good informative about our nation housing market. We still have long way to see the bottom. It is very good research report from Harvard. Worth to read!!

Thursday, June 18, 2009

Who want to be the Fool ??

Folks, go check out my chinese blog http://www.cigstockchart.blogspot.com. Then add one more good reason on the following:

$165 billion in Treasuries for sale in the next week?

$31 billion in 3-month bills

$27 billion in 7-year notes

$40 billion in 2-year notes

$37 billion in 5-year notes

$30 billion in 6-month bills

Annualized this is $8.58 trillion dollars!

Now obviously they won't keep doing that for the next 52 weeks (one hopes) but you have to be smoking something if you think the market can continue to absorb this sort of supply and shrug it off.

My comment: Opps, big selloff is coming next week!! Watch out folks!!

Wednesday, June 17, 2009

Cliff Diving of State Personal Income Tax

6/17/09

6/17/09Here you go! I find out which states are in trouble receiving Income tax for budget. California isn't the worst, but the state relies heavily on income taxes. Arizona is just getting crushed - and the pain is widespread. There four states has no data. Now, we get more clear on who is going to be next California. Are we going to bail all out?! I do not know. Go figure yourself!!

Tuesday, June 16, 2009

FDIC just release Big $$$$

6/16/09

Click to see bigger and clear!! See it and believe it!! The FDIC released the Summer 2009 Supervisory Insights today. The report includes the above table showing all the government support announced in 2008 and soon thereafter. The maximum capacity is $13.9 trillion. Yes, it is no wrong....""$13.9 Trillion"".

My interpertation of recent stock market rally

6/16/09

Since 3/6/09, us stock market has rallied up about 38% from bottom. A combination of growth or recovery optimism and inflation fear has sprung up asset markets in the past 3 months. Fundamentally, some economic data do seemed bottom. However, there are still some leading indicators are posting slower rate of contraction. Yes, Federal stimulus money is working on its way(It looks like but I do not feel it beside pumping/wasting money into varies scheme).

Technically, after close to 18months declining market, it was time due for technical rebound. The degree of this bear market rally is so intense because it has dropped so severly since Lehman Brother collapsed.

Contrary to all the market noise with different thoeries to explain this rally is real or not, there are no signs of a signifiant economic recovery. So called "green shoots" in the global economy or US economy are mostly due to inventory cycles. Print money resuce efforts may juice up growth a bit for the rest of year. Nothing suggests this is a lasting and sufficient recovery. Global stock markets are trading on imagination.

My conclusion: Do not get trap again despite majority of people saying "Economy has bottomed and we are in the way recovery" I do not believe this "BS" Time will prove those people correct or not. I am expecting another downwave coming near end of this year or beginning of next year.

Monday, June 15, 2009

States Bonds Rating Game!!!

6/15/09

What would be next to Budget shortfall like California in our so proud nation? Florida, Ohio, Michigan, Nevada, Illinois,...the list is going on. What would you all think if Federal is really going to bail out CA? Would you feel it is fair? And more states to come? Today, Whole world is reduce purchasing our nation government bonds significantly. If this condition is getting worst, who else support our debts? We are just meaning to print more and damn more money. That's it!! Print more money is the one and only one policy that folks in white house is doing. Umm...I vote for Democrat but they seems have no idea what and how to solve this mess.